Property tax penalties are not a one-time thing. As you may know, property taxes are due by January 31st every single year. If you don’t have them in by that date, you’re in delinquency — and looking at a 7% penalty on February 1st. What if you still don’t have them in by March 1st? The interest and penalty for late property tax payment will keep going up. How often? Every month that you’re still past due, your rate will increase by another 2%. That is, until July 1st, at which time you’ll be charged a giant collection fee of 22% on top of all the property tax penalties you’ve accrued. Beginning August 1st, at least 1% is added each month there after on any unpaid balance. If that seems like a lot, it is.

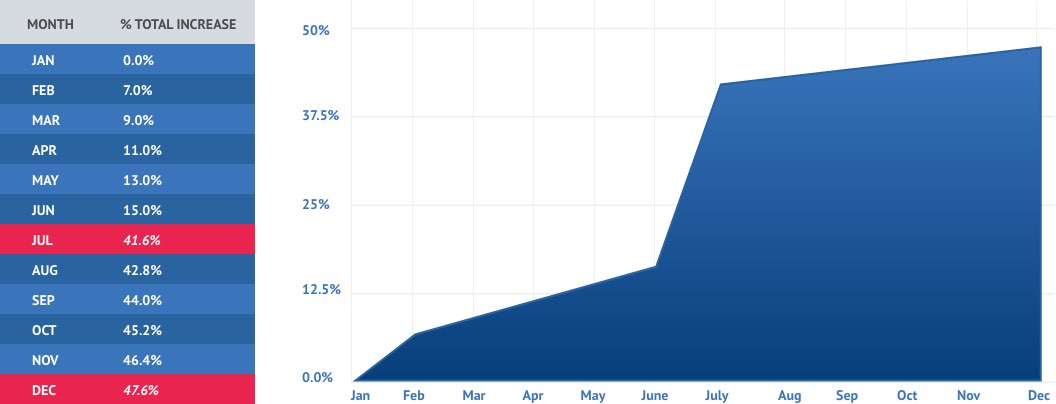

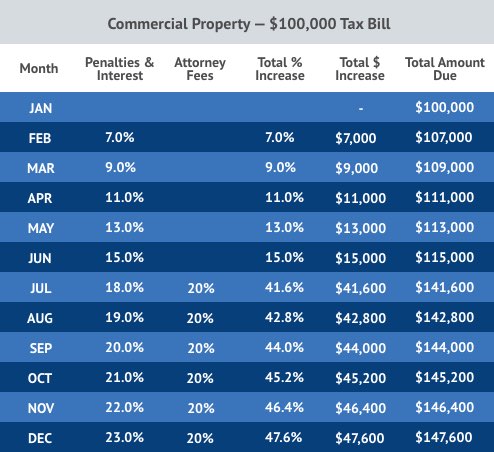

Texas Property Tax Penalty and Interest Chart

Once you’re delinquent, it’s quite easy for the property tax penalty fees to keep piling up. After all, Texas has some of the highest property tax rates in the United States. Plus, there’s the previously mentioned 20% collection fee if you haven’t paid by July 1st — which means that, by that time, you’ll be staring at around 41.6% total property tax penalties, interest and fees. And it doesn’t stop there — you’ll hit 47.6% within the first year. To help wrap your head around all of this, take a look at our Texas property tax penalty and interest chart.

For Help with Delinquent Property Taxes, Turn to Tax Ease

Looking at the chart, it's easy to see that property tax penalty and interest rates can quickly get out of hand. If you're facing delinquency, it's not time to get scared of the ticking clock — it's time to act. It's time to talk to Tax Ease. With our Texas property tax loans, you can get some breathing room. We'll help you avoid high property tax penalties and work with you to set up a plan that fits your budget and timeline. Contact us today to see what we can offer!